REALSTEPs

Investment Properties

Your Trusted Partner in Real Estate

Investment Process

Investment property in Germany

WHY PURCHASING AN INVESTMENT PROPERTY IN GERMANY IS SO ATTRACTIVE?

- Your benefit increases exponentially by holding the investment property for 10 years as you will pay no capital gains tax on the sale!

- Rents in Germany have been rising significantly in recent years, driven by: low unemployment, strong economy, growing immigration and professionals looking for a balanced lifestyle and a safe country to work and live.

- Investors can benefit from many tax deductions strategies including property depreciation, which can reduce your taxable income on a yearly basis.

- You will be acquiring a tangible asset, which based on past data analysis has been increasing over time and provides short, medium and long term Generational Wealth.

- People may refrain from purchasing the latest jacket, or suit but finding a rental property is a must for many as they need a place to live.

Businesss in Germany

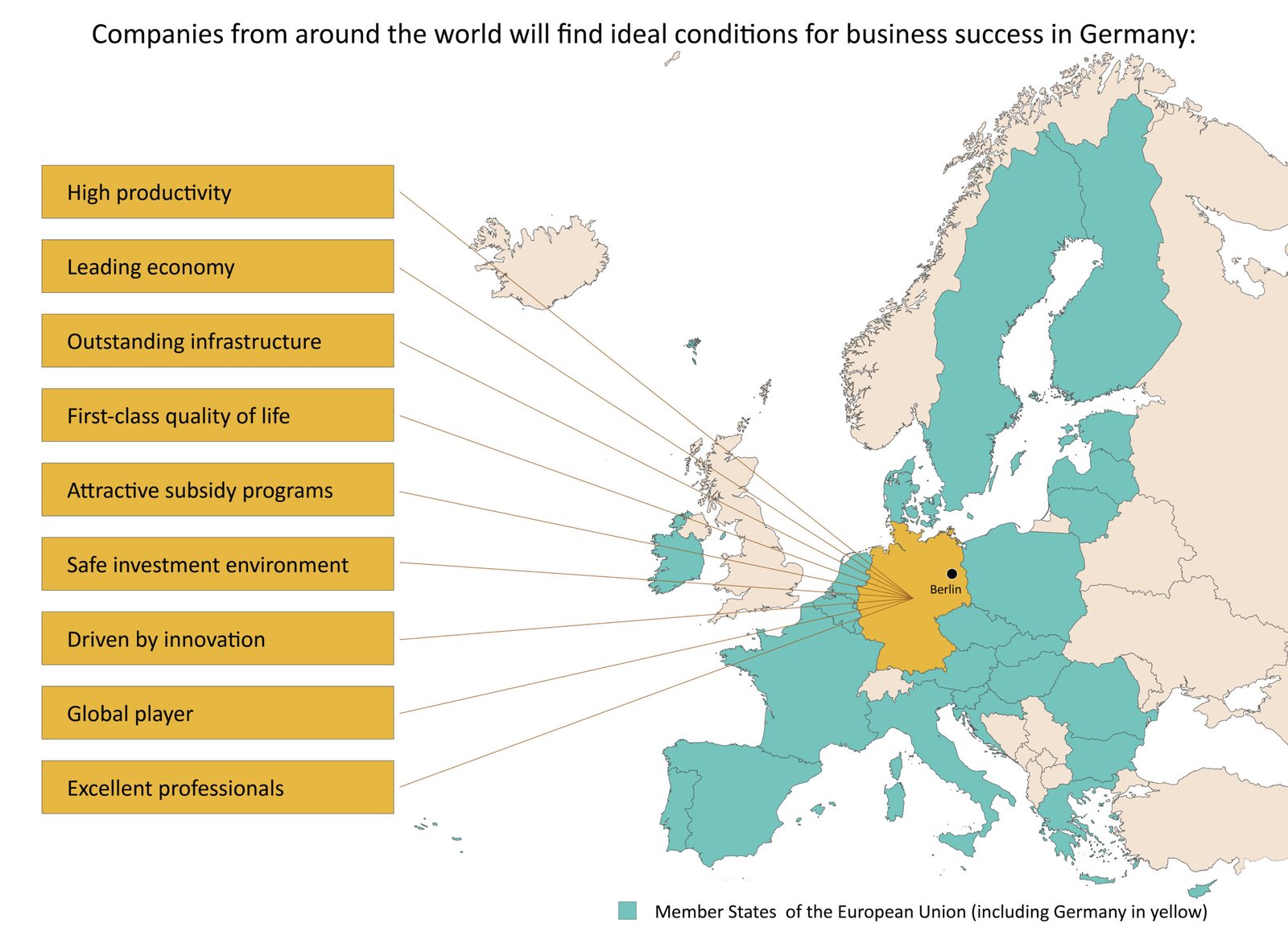

ADVANTAGES OF INVESTING IN GERMANY?

- Germany is a central hub for international business and trades, attracting investors and creating a continuous influx of expatriates and international professionals wanting to move to Germany.

- "Made in Germany" is recognized across the globe as superior quality of its products and affirms the high level of perfection.

- With the largest population in the European Union and the highest GNP, Germany is Europe's most important market.

- Consistent Growth: The German real estate market has shown consistent growth over the years, with property values steadily increasing in many locations across Germany.

- Germany is the starting gate to the emerging markets of Central and Eastern Europe.

- Germany is one of the most important advocates in the development of top-innovation particularly in Technology, science and research.

- Germany is recognized as a world leader in nanotechnologies and number 1 in Europe.

- Many biotechnology firms choose Germany to found their companies than in any other country in Europe.

- Germany offers a stable political system which provides long-term reliability and the capacity to plan ahead when looking at the medium and long term projection.

- Germany has a reliable infrastructure that functions extremely well, while ensuring social order and a balanced work and personal life.

Businesss in Germany

Difference between a Real Estate Investment and a self-use home

The primary difference between a property investment and a primary home lies in their intended use: personal residence versus a rental income stream generation. This distinction is very important as part of the financial assessment, tax implications, management practices, risk levels, and legal considerations. Understanding these differences is crucial for making informed decisions in both scenarios.

Real Estate Investment

Income Generator

A real estate investment is purchased with the primary objective to generate income through rental and to profit through the value appreciation overtime when you sell it!

Tax Benefits

Rental investment provides numerous tax benefit deductions that could be used to lower your total taxable income depending on your financial situation.

Business Decision

The decision is typically driven by financial and market analysis rather than emotional preference.

Financing

Banks take into consideration the rental income from the tenant as part of their analysis, as they recognize there is a 3rd Party paying the rent.

Downpayment

Ability to obtain financing with lower down payment, therefore leveraging to a greater extent the tax benefit.

Self-Use Home

Primary Home

A primary residence is the house you choose to live in most of the year. It is your personal residence.

Emotional Investment

It is important to separate the Investment property from the Primary home. The Primary Home has the Emotional aspect as it involves emotional considerations, such as: proximity to other family members, work, school and community facilities.

Liability

Primary homes are often viewed as a Liability on the Balance Sheet versus an Assets as it Takes money from your pocket.

Financing

Banks follow a more in-depth due diligence review for Primary home loan as the only person responsible to pay the loan is the client instead of a third party person.

Down Payment

Banks often request a larger portion of the downpayment when clients purchase their primary home.

Additional Upgrades

Primary homes often require further upgrades and renovations therefore money needs to be put aside to these expenses.